Ola Pioneers a First-Of-Its-Kind In-Trip Insurance Program For Customers

~ Extending ‘Chalo Befikar’ to the customer side, an industry first program that offers an insurance policy of INR 5 lacs as well as cover for missed flights and loss of baggage ~

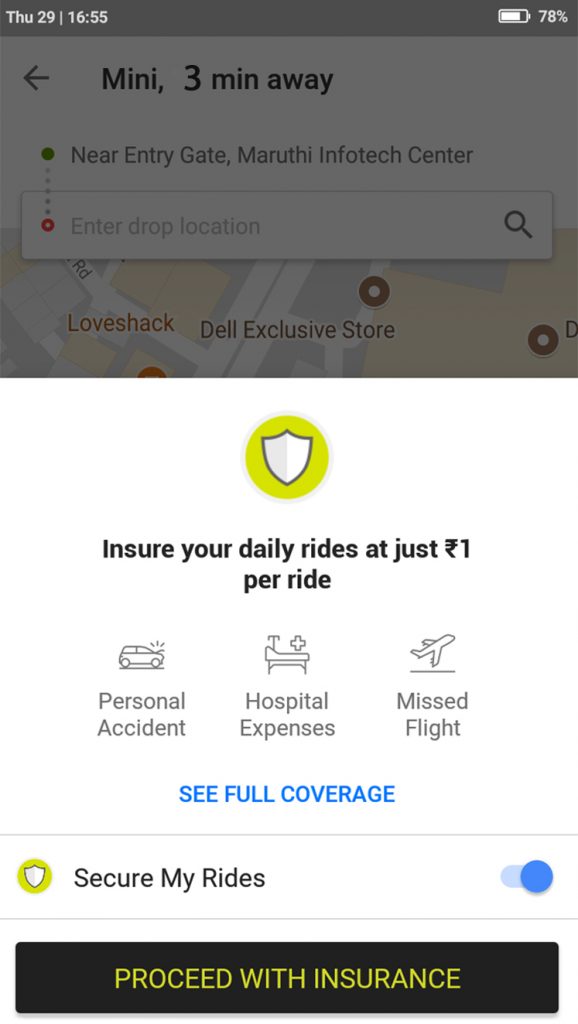

- Commuters can opt for an in-trip insurance cover at a premium of INR 1 per ride for intra-city travel; INR 10 for Ola Rentals; INR 15 for Ola outstation

- Ola has partnered with Acko General Insurance Ltd. to launch the program across 110+ cities in the country

Bengaluru, 5th April 2018: In a big step towards enhancing customer experience, Ola, India’s leading and one of the world’s largest ride-sharing companies, launches a comprehensive in-trip insurance program for its customers across India. Extending the benefits of the ‘Chalo befikar’ insurance program to its customers, Ola becomes the FIRST smart mobility platform in the country to offer an in-trip insurance cover to its users, across all categories viz. cabs, auto, kaali-peeli, and e-rickshaw. Ola has partnered with Acko General Insurance Ltd to launch this program designed to benefit its customers across 110+ cities. A user booking an Ola ride can opt for an in-trip insurance cover while booking the ride at a premium of INR 1 for all intra-city travel; INR 10 for Ola Rentals; INR 15 for Ola Outstation.

The first-of-its-kind program is being rolled out for customers in major metros and will be scaled up to all cities, covering the entire base in the coming weeks. The comprehensive insurance program provides benefits in cases of loss of baggage or laptops, missed flights, accidental medical expense, ambulance transportation cover, and much more. The optional in-trip insurance program can be purchased through the Ola app. The claims can be made through the Ola app as well as Acko’s website, mobile app and, call center. Ola’s partnership with ICICI Lombard General Insurance Ltd will be live in the coming months.

Vishal Kaul, Chief Operating Officer at Ola said, “We are thrilled to introduce in-trip insurance for our customers under the ‘Chalo Befikar’ insurance program. Just for INR 1, Ola customers can avail an insurance policy of INR 5 lakh which will also provide cover for missed flights, loss of baggage, loss of laptop, emergency hotel requirements, and many more. The launch of this initiative, a first of its kind in India, reiterates our resolve of building customer-first solutions.”

‘Chalo Befikar’ has been extremely beneficial for Ola driver partners, extending the benefits to customers as well is the right step forward, bringing the entire ecosystem under this essential insurance program.

Varun Dua, Founder & CEO, Acko General Insurance Ltd. said, “Ola is a pioneer of mobility in India and Acko is excited to partner with them. Together with Ola we have created a first of its kind in-trip insurance that would be of great value to millions of Ola users and would ensure that their daily commute is stress-free. We have been able to develop an easy to understand product that is delivered seamlessly to the user. As India’s first insure-tech player we made this possible with our capabilities in product design along with our technology platform that is capable of high volume insurance transactions in real time for both policy issuance and claims management.”

Sanjeev Mantri, Executive Director, ICICI Lombard General Insurance Company Ltd. said, “At ICICI Lombard, we are proud to partner with Ola, India’s leading ride sharing platform. We are happy to offer yet another of our innovative digital insurance solutions to their customers. As India’s leading general insurance company, we have always been ahead in terms of introducing new age solutions that address the emerging market dynamics and meet the requirements of India’s young and aspiring consumers. We believe that this partnership will immensely benefit Ola’s large base of customers.”

How can a customer avail in-trip insurance program?

- New user → in-app communication while booking a ride

- Menu → profile → ride insurance → toggle insurance ‘on’ (once a customer has given his/her consent, insurance is charged on all his/her future rides unless the toggle is put to ‘off’)

The in-trip insurance will cover the following:

| Benefits | Insurance Cover (INR) | Ola Micro, Mini & Prime and auto | Ola Rental | Ola Outstation |

| Accidental Medical Expense | 1,00,000 | Yes | Yes | Yes |

| Hospital Daily Allowance (Max 7 days) | 500/day | Yes | Yes | Yes |

| OPD Treatment | 3,000 | Yes | Yes | Yes |

| Ambulance Transportation Cover & Evacuation (Medical and Catastrophe) | 10,000 | Yes | Yes | Yes |

| Accidental Death Benefit | 5,00,000 | Yes | Yes | Yes |

| Permanent Total Disability | 5,00,000 | Yes | Yes | Yes |

| Permanent Partial Disability | 5,00,000 | Yes | Yes | Yes |

| Repatriation of Mortal Remains | 10,000 | Yes | Yes | Yes |

| Missed Carrier (Domestic flights only) | 5,000 | Yes | No | Yes |

| Loss of Baggage and Personal Effects & Electronic Equipment Cover(Laptop only) | 20,000 | No | No | Yes |

| Emergency Hotel Requirement | 10,000 | No | No | Yes |

| Home Insurance Cover & Fire and Allied Perils | 1,00,000 | No | No | Yes |

About Ola:

Founded in 2011 by Bhavish Aggarwal and Ankit Bhati, Ola is one of the world’s largest ride-sharing companies. Ola integrates city transportation for customers and driver-partners onto a mobile technology platform ensuring convenient, transparent, and quick service fulfilment. Ola is focused on leveraging the best of technology and building innovative solutions ground-up, that are relevant at global scale. Notably, in 2016, Ola Play the world’s first connected car platform for ride-sharing was launched, transforming commuting experiences and setting the tone for global innovation in this space. Using the Ola mobile app, users across 110+ cities, can connect with over 1,000,000 driver-partners across cabs, auto-rickshaws, and taxis. Driven by a hyperlocal approach, Ola is committed to its mission of building mobility for a billion people

About Acko:

Acko is an independent general insurance company with its entire operations offered through the digital platform. It will provide personalized products after measuring customer behavior using data analytics. Set-up by Varun Dua, previously founder of Coverfox, Acko has raised $30mn, which in effect makes it one of the largest seed rounds for a start-up in India. The company is backed by Narayan Murthy’s Catamaran Ventures, Accel and SAIF Partners, Kris Gopalakrishnan, Co-founder Infosys, Hemendra Kothari of DSP Blackrock, Atul Nishar – Founder & Chairman of Hexaware Technologies, Rajeev Gupta, veteran investment banker and Founder of Arpwood Capital, Venk Krishnan and Subba Rao of NuVentures, Swiss Re & Transamerica Ventures.

About ICICI Lombard:

We were the largest private-sector non-life insurer in India based on gross direct premium income in fiscal 2017, a position we have maintained since fiscal 2004 after being one of the first few private-sector companies to commence operations in the sector in fiscal 2002. We offer our customers a comprehensive and well-diversified range of products, including motor, health, crop, fire, personal accident, marine, engineering and liability insurance, through multiple distribution channels. More details are available at www.icicilombard.com

For media queries, please reach out to media@olacabs.com.